- arrow_back Home

- keyboard_arrow_right Market Analysis

BINANCE COIN PRICE ANALYSIS & PREDICTION (March 3) – Will BNB Repeat History Following This Bullish Formation?

Market Analysis Michael Fasogbon March 3, 2025

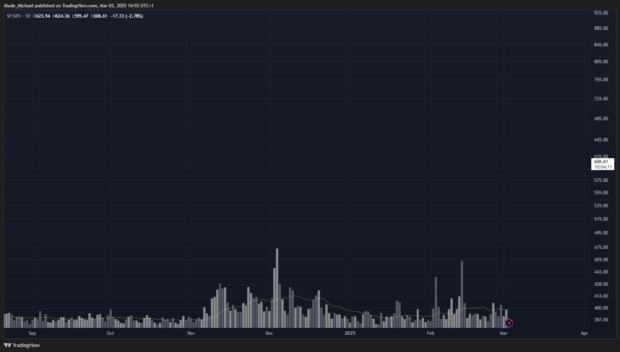

Following the latest recovery, BNB saw a notable gain and traded back above $600. While slowing down buying today due to a rejection, we can expect a bigger bullish rally if it follows last August’s recovery pattern.

Binance’s native coin has been showing signs of bullish movement since last month, but the signal is not clear yet as it continues to face rejections on the short-term trend. While prices may change anytime soon, it remains within the bearish territory on the daily outlook.

However, the market landscape may take a new shape soon following the sudden bounce from a low of $500 in early February. That bounce led to a major recovery, and the price increased to above $700. Sadly, the momentum was short-lived and the asset lost grip.

Creating a new support above that low in the late month, the price picked up and rallied to $635. Trading appears a bit weak today due to a slight rejection at this level. An increase above it should stage more recoveries capable of activating a fresh bullish rally on the daily chart.

Technically, this price action looks like the August 2024 recovery pattern from a low $400, which sent the price massively to a new high of $794. If BNB repeats this pattern, it may rally hard to a new high in the next month. As of now, the price is trying to stay above the $600 level.

BNB Key Level To Watch

A push above the $635 level should allow more recoveries to the $660 and $686 resistance levels. Higher price levels to watch for a major shift would be $700 and potentially $745

If BNB resumes selling, the support level to watch for a drop is $587. A further price drop could roll the price to the $559.7 support level and potentially $544.

Key Resistance Levels: $635, $686, $700

Key Support Levels: $587, $559.7, $544

- Spot Price: $606

- Trend: Bearish

- Volatility: High

Disclosure: This is not trading or investment advice. Always do your research before buying any Metaverse crypto coins.

Argin Chronicles Copyright © 2025.